Last Updated July 5, 2025

Table of Contents

- What is Florida Security Deposit Law

- Key Provisions of Landlord Tenant Law in Florida

- What Can a Landlord Deduct from a Security Deposit?

- How Many Days Does a Landlord Have to Return a Security Deposit?

- How to Return a Security Deposit – Step-by-Step Guide

- What Happens If a Landlord Fails to Return the Deposit?

- Florida Security Deposit Demand Letter Sample

- New Florida Security Deposit Law 2024

- Florida Tenant Rights and the Importance of Documentation

- Rent Increase Notice Sample Download

- How Allegiant Management Group Can Help

- Watch: Florida Security Deposit Laws Explained

- Frequently Asked Questions (FAQs)

When To Return Security Deposits in Florida

The number of renters in the United States grew significantly from 2022 to 2023, reaching over 44 million households. Analysts expect that number to increase by at least 20% by mid-2025.

For Florida landlords, understanding security deposit laws is essential to avoid disputes and stay compliant. These laws explain what landlords and tenants can expect at the end of a lease. They include details on when and how to return the security deposit.

Landlords use security deposits to protect themselves against unpaid rent or damages to their rental units. However, landlords must follow Florida law when collecting, holding, and returning these funds. Complying with Florida Statute 83.49 helps protect your investment and ensures fair treatment for all parties involved.

What is Florida Security Deposit Law

Florida Statute 83.49 regulates how landlords must handle security deposits. The security deposit law Florida requires that landlords:

Return the full security deposit within 15 days if no deductions are needed.

Provide a written notice within 30 days if they plan to make any deductions.

It’s important to notify tenants in writing and have proof of delivery. This helps avoid misunderstandings and legal issues.

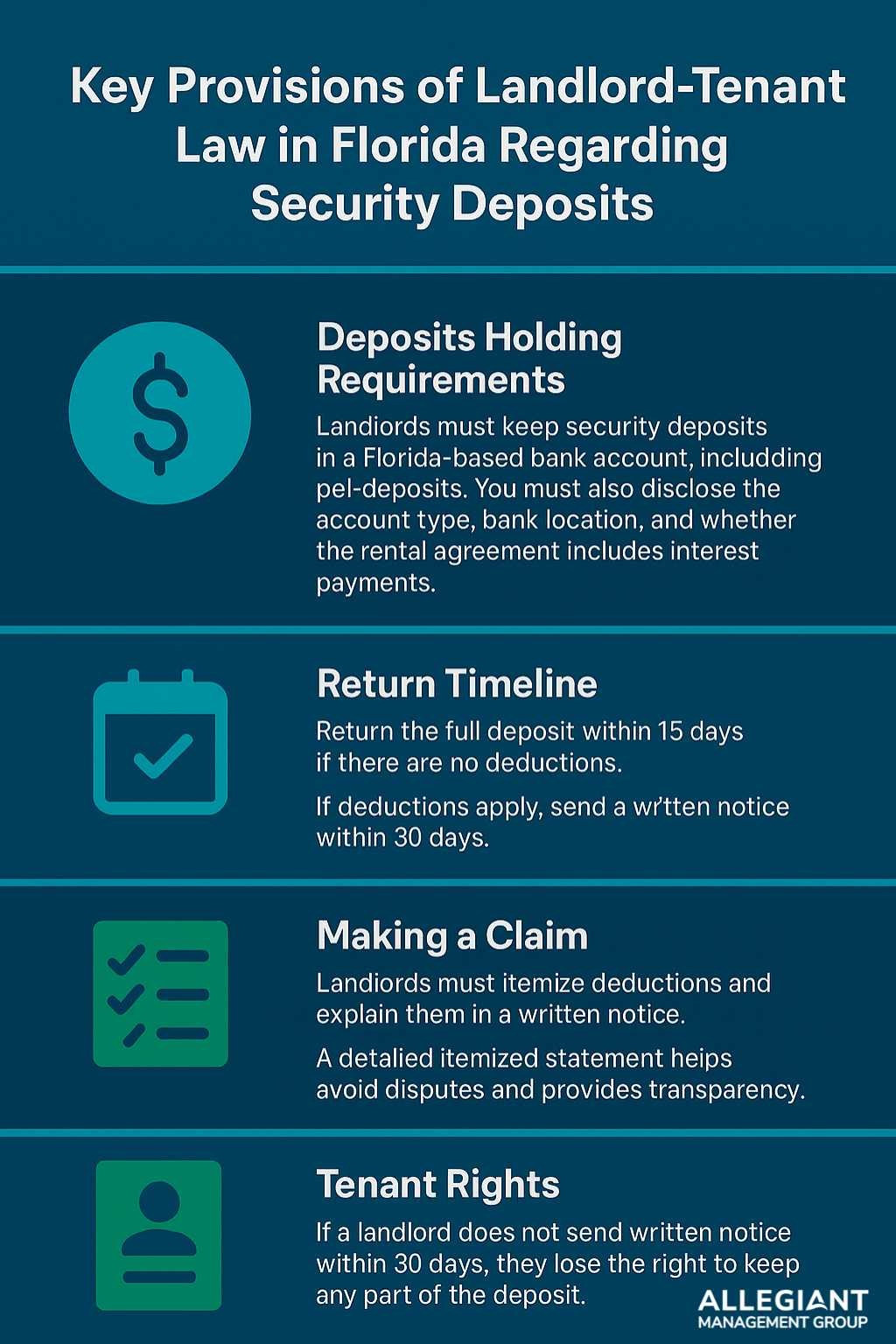

Key Provisions of Landlord Tenant Law in Florida Regarding Security Deposits

Deposit Holding Requirements

Landlords must keep security deposits in a Florida-based bank account. This includes pet deposits. You must also disclose the account type, bank location, and whether the rental agreement includes interest payments.

Return Timeline

Return the full deposit within 15 days if there are no deductions.

If deductions apply, send a written notice within 30 days.

Making a Claim

Landlords must itemize deductions and explain them in a written notice. A detailed itemized statement helps avoid disputes and provides transparency. If a tenant disagrees, they can contest the deductions through a formal process.

Tenant Rights

If a landlord does not send written notice within 30 days, they lose the right to keep any part of the deposit. This is true even if there are damages or unpaid rent. Tenants can also submit written objections with supporting evidence such as photos or move-in checklists.

Talk to a Florida property manager today →

What Can a Landlord Deduct from a Security Deposit?

According to Florida law, landlords can deduct from a tenant’s security deposit for the following reasons:

Unpaid rent

Damages beyond normal wear and tear (holes in walls, broken appliances, stained carpets)

Excessive cleaning costs

Unpaid fees, such as late rent or utility bills

How Many Days Does a Landlord Have to Return a Security Deposit

Florida law gives landlords 15 days to return the full security deposit if no deductions are being made. If landlords need to make deductions, they must send a written notice within 30 days.

Many experts recommend using certified mail and returning funds within 14 days to avoid delays or disputes.

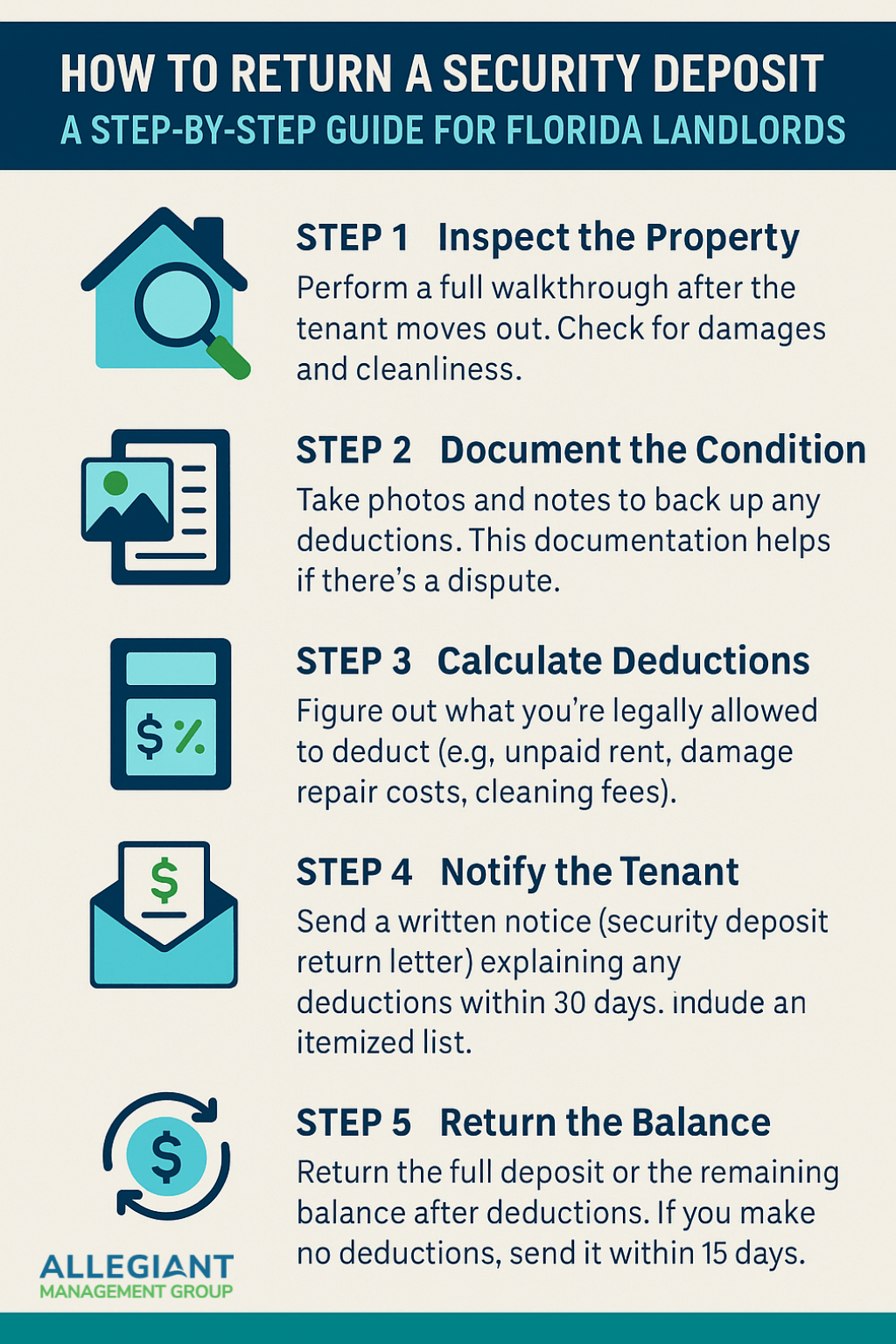

How to Return a Security Deposit – Step-by-Step Guide for Landlords

Step 1: Inspect the Property

Perform a full walkthrough after the tenant moves out. Check for damages and cleanliness.

Step 2: Document the Condition

Take photos and notes to back up any deductions. This documentation helps if there’s a dispute.

Step 3: Calculate Deductions

Figure out what you’re legally allowed to deduct (e.g., unpaid rent, damage repair costs, cleaning fees).

Step 4: Notify the Tenant

Send a written notice (security deposit return letter) explaining any deductions within 30 days. Include an itemized list.

Step 5: Return the Balance

Return the full deposit or the remaining balance after deductions. If you make no deductions, send it within 15 days.

Step 6: Know the Dispute Window

After receiving your notice, tenants have 15 days to dispute the claim. If they don’t respond, the deductions stand.

Talk to a Florida property manager today →

What Happens If a Landlord Fails to Return the Deposit

If a landlord in Florida does not return the deposit on time, they lose the right to take money from it. This rule applies even if there are damages.

Tenants can sue in small claims court to recover the full amount. If the court finds the landlord acted in bad faith, additional penalties may apply.

Security Deposit Disputes - Florida Deposit Demand Letter Sample

If your landlord has not returned your security deposit, you can send and write a security deposit demand letter. Click here to access a Florida Security Deposit Demand Letter Sample PDF.

New Florida Security Deposit Law 2024

As of July 1, 2024, a new Florida law gives landlords and tenants more flexibility. Landlords can now offer alternatives to traditional deposits, such as:

Monthly deposit waiver fee in lieu of deposit.

Insurance-based deposit replacements

These alternatives reduce upfront costs for tenants while still protecting landlords. However, landlords must disclose these options in writing and obtain tenant consent. Failure to comply with the new Florida security deposit law could lead to legal issues.

Florida Tenant Rights Security Deposit Law and The Importance of Documentation

Tenants can dispute deposit claims through small claims court, often without hiring an attorney. Documentation is key—tenants should gather move-in photos, cleaning records, utility receipts, and the lease agreement.

Reminder: You cannot use a security deposit for last month’s rent. The lease must state this, and both parties must agree to allow it.

Rent Increase Notice Sample Download

Looking for a Rent Increase Notice sample? Download your Free Rent Increase Notice template.

How Allegiant Management Group Can Help

At Allegiant Management Group, we help Florida property owners manage every part of the leasing process—including security deposits. We:

Hold deposits securely in escrow

Prepare itemized deduction notices

Ensure legal compliance with state laws specifically Florida Statute 83.49

Collect Rent

Market Rental Properties

Whether you need full-service property management or a-la-carte solutions, our experienced team is ready to help. We work hard to protect your property and your peace of mind.

Visit our website to learn more or contact us for expert support.

WATCH: Florida Security Deposit Laws Explained

For a quick overview on Florida’s security deposit laws, check out this helpful video:

Frequently Asked Questions (FAQs) - Security Deposit Law Florida

How long does a landlord have to return my security deposit in Florida?

Florida landlords must return a security deposit within 15 days if there are no deductions. If they intend to make deductions, they must notify the tenant in writing within 30 days. After notification, they have 30 more days to return the remaining amount.

What can a landlord deduct from a security deposit in Florida?

A Florida landlord can deduct for unpaid rent, property damage beyond normal wear, cleaning costs, and breach of lease terms. All deductions must be itemized and sent in writing within 30 days of lease termination.

Can I use my security deposit for last month’s rent?

No, Florida tenants cannot use the security deposit for last month’s rent unless the lease explicitly allows it. Doing so without permission may result in legal action or loss of the deposit.

What should I do if my landlord doesn’t return my deposit?

Send a written demand requesting the deposit. If the landlord doesn’t respond or refuses without justification, file a claim in small claims court. Florida law allows tenants to recover the deposit plus court costs if successful.

What should you include in a security deposit demand letter?

Include your name, rental address, move-out date, deposit amount, and a clear request for its return. Cite Florida law (Fla. Stat. § 83.49) and set a deadline. Keep the tone formal and send via certified mail with return receipt.

What happens if a landlord doesn’t return the deposit in 30 days?

If a Florida landlord fails to return the deposit or send a notice of intent to deduct within 30 days, they forfeit the right to make deductions and must return the full amount. Tenants can sue if the deposit isn’t returned.

How long does a tenant have to dispute deductions?

A Florida tenant has 15 days from receiving the landlord’s notice of intent to impose a claim to dispute the deductions in writing. Failure to respond allows the landlord to deduct the stated amount.

Do landlords have to provide receipts for deductions?

Florida law doesn’t require landlords to provide receipts, but they must send a written itemized list of deductions. Providing receipts strengthens their claim and may be required in court if the tenant disputes the charges.

Does the security deposit count toward rent?

No, a security deposit does not count toward rent unless the lease agreement specifically states otherwise. Using it for rent without approval may result in eviction or legal action.

Disclaimer: This blog is for information purposes only and is not legal advice. Please consult a licensed attorney for legal guidance related to your rental property or tenant disputes.